Canola futures closed higher on Monday, boosted by the strong performance of the Chicago soy complex.

China demand hopes and strong October crush data sent the soy complex sharply higher, with the nearby January soybean contract jumping nearly 33 cents/bu on the day. Advances in European rapeseed and palm oil supported canola as well, although crude oil slipped lower.

Declines in the Canada dollar added to the upside in canola, while weaker 2025-26 export demand for Canadian canola compared to a year earlier was a bearish influence.

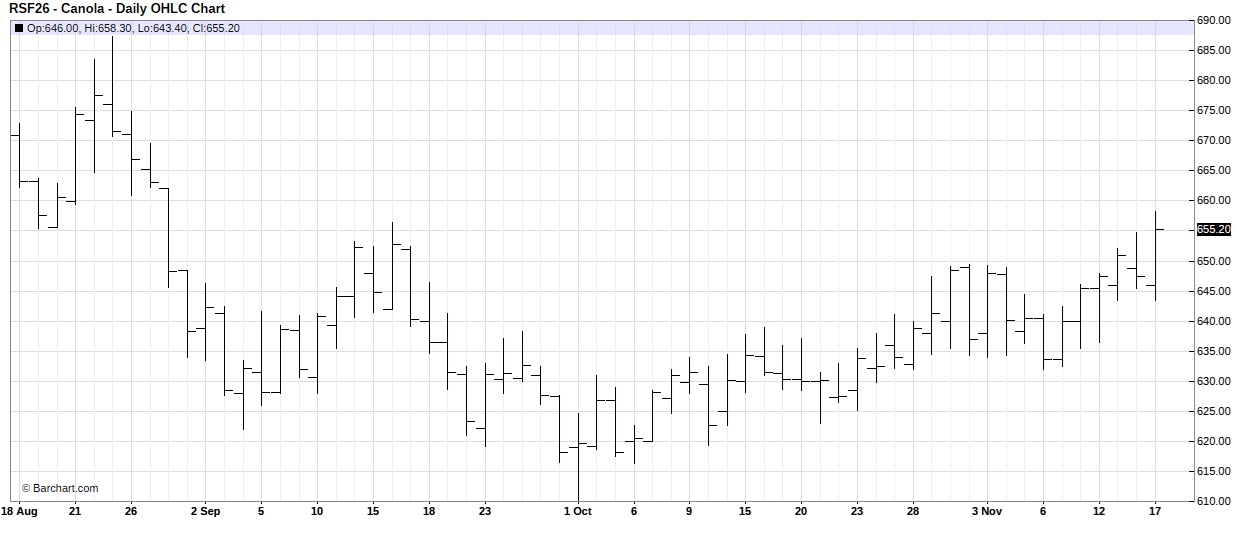

January canola gained $7.70 to $655.20, and March was $8.10 higher at $666.70.

As can be seen on the futures chart below, January canola is now trading at its highest since late August.

January canola: source - Barchart